In 2017, commercial operations in Mexico were the main driver of Grupo Famsa’s consolidated results. Net sales there grew 3.0% compared to 2016, reflecting Management’s emphasis on enhancing profitability and efficiency in all areas of the organization, and a permanent focus on growing sales through attractive advertising campaigns and promotions both on and outside the sales floor.

Famsa USA’s net sales in USD and MXP fell 19.7% and 19.2%, respectively, in 2017, largely reflecting the Hispanic population’s uncertainty over the migratory pressures generated by the U.S. federal government and, to a lesser extent, the appreciation of the Mexican peso. However, a refocusing on our U.S. target market and the efficiencies we have achieved in the structure of expenses in that country stabilized Famsa USA’s operations which improved significantly in the fourth quarter of 2017 compared to previous quarters. This achievement leads us to expect a recovery in results in the United States in 2018.

Because of the combination of improved operational results in Mexico and the decline in revenues in the United States, 2017 consolidated net sales remained flat year-over-year. Despite this, consolidated EBITDA totaled Ps.1,824 million in 2017, 29.2% above the Ps.1,411 million posted 2016. As a result, consolidated EBITDA margin grew 240 basis points as of yearend 2017, to 10.4%, compared to 8.0% in 2016.

With regard to the company’s financial position, the 2017 consolidated loan portfolio, net of provisions, was Ps.25,200 million. It is important to note that the company adopted two new International Financial Reporting Standards (IFRS): i) IFRS 9 “Financial Instruments” and ii) IFRS 15 “Revenues from contracts with clients”, in advance and retroactively to January 1, 2017. These standards affected the calculation of the reserve for the deterioration of the company’s consolidated loan portfolio, and in the amount committed to the consideration, taking into account the effects of the value of money over time.

Banco Famsa’s Non-performing Loans Ratio (IMOR) continued to decline during the year, falling to 8.4% at the close of 2017, still at historical minimum levels. This achievement reflects the implementation of the previously mentioned actions to improve asset quality by assuring stricter loan origination standards and to reinforce the collection area, in an effort to optimize the levels of containment and deterioration of the bank’s different loan portfolios.

The consolidated commercial loan portfolio grew 18.1% annually, to Ps.4,360 million as of December 31, 2017, with a Non-performing Loans Ratio (IMOR) at its lowest level of 1.5% as of the close of the year. In consolidated terms, the Non-performing Loans Ratio was 15.8%, compared to 14.3% in 2016.

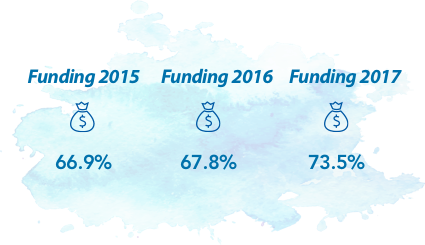

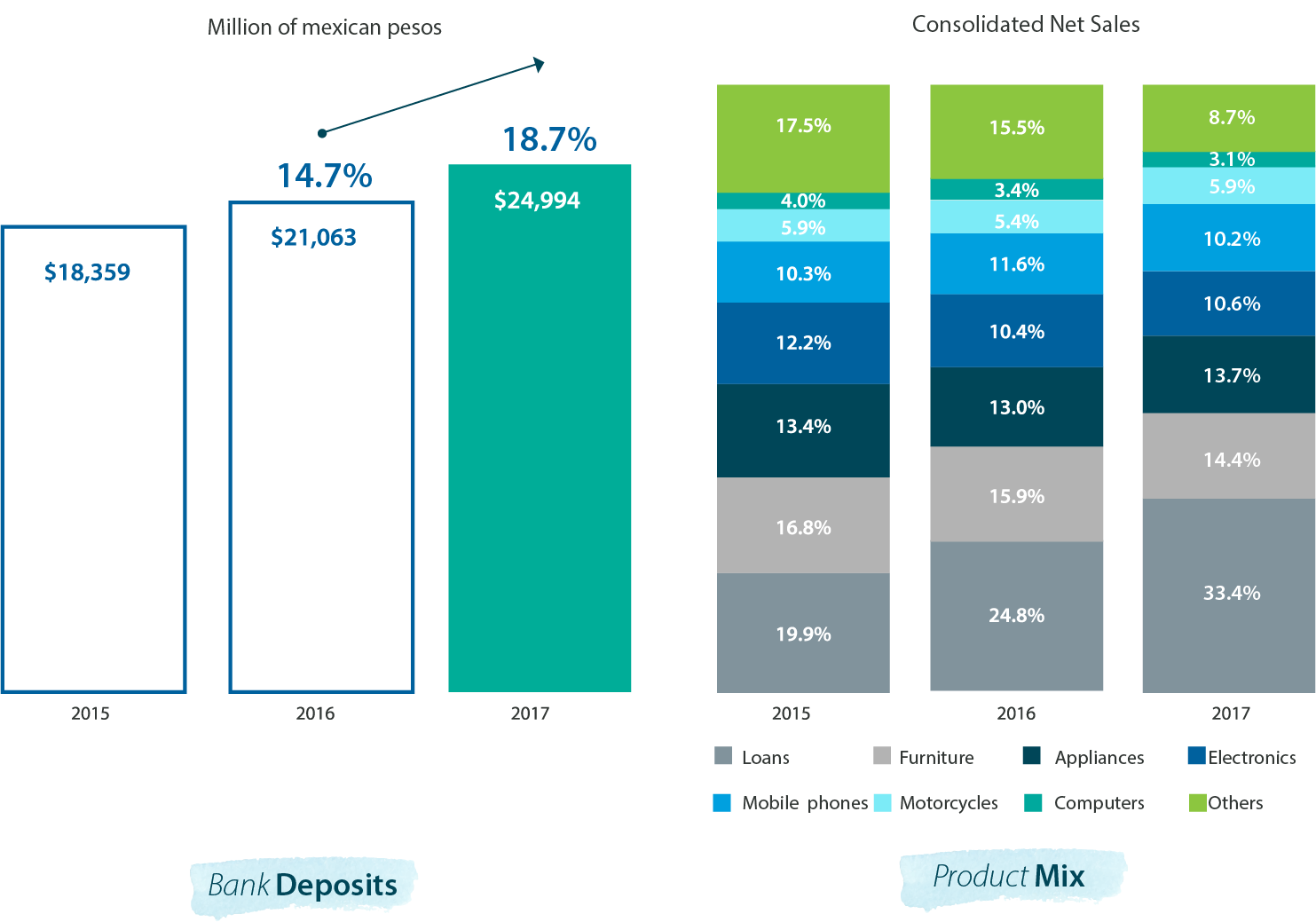

Bank deposits are Grupo Famsa’s main source of funding, and represented 73.5% of total funding as of year-end 2017, compared to 67.8% in 2016. The bank deposits generated in Banco Famsa grew a significant 18.7% year-over-year in 2017, totaling Ps. 24,994 million as of December 31, 2017.

With the assurance that we are moving in the right direction, in 2018 we will redouble our efforts to ensure that Grupo Famsa’s sales and profitability indicators continue to rise as they did in 2017 in our operations in Mexico, and that operations in the United States recover significantly.