Since its founding, Grupo Famsa has implemented specific initiatives to promote the company’s continuous growth, assuring that they also contribute to maintaining a robust, flexible financial structure and generating new opportunities for value creation.

During 2017, we executed diverse strategies to strengthen Grupo Famsa’s financial position. These translated into significant upswings in the main profitability indicators.

Major achievements during the year included the execution of our asset monetization plan, the reduction of the balance of consolidated gross debt and its exposure to the U.S. dollar, an improvement in the company’s debt maturity profile and the successful implementation of a program to reduce operating expenses, both in Mexico and the United States.

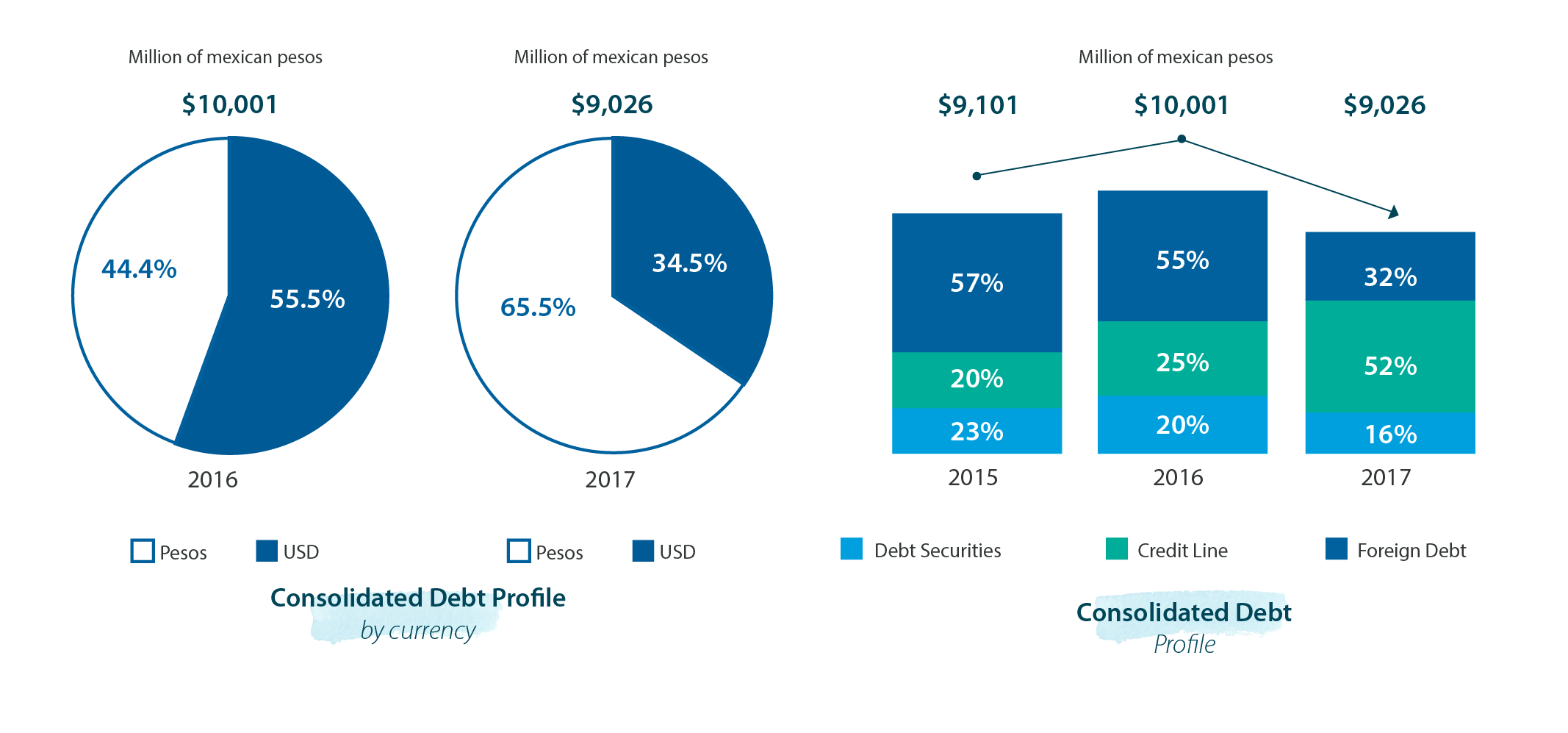

With regard to the resources generated from real estate asset monetization, during 2017 Ps.1,127 million were obtained, which were largely used to pay short-term liabilities. In addition, we subscribed to a credit facility of Ps.2,634 million from Banco Nacional de Comercio Exterior, S.N.C. (“BANCOMEXT”), Mexican Exim Bank. These resources were used to redeem a total of US$110 million in senior notes with a maturity date in 2020. The contracting of this new credit strengthens Grupo Famsa’s financial position by pushing out the average maturity of the company’s consolidated debt and substantially reducing financial leverage. In addition, we achieved an important reduction in Grupo Famsa’s exposure to foreign exchange risk, lowering dollar-denominated liabilities from 55.6% of total liabilities at the close of 2016 to 34.5% at year-end 2017.

Likewise, the consolidated debt registered a significant reduction, of 9.7%, lower than the previous year, totaling in Ps. 9,026 million.

The balance of Grupo Famsa’s consolidated gross debt as of December 31, 2017 was Ps.9,026 million, 9.7% lower than the previous year, largely because of the use of resources from asset monetization.

Regarding consolidated operating expenses, it is important to highlight that 2017 was characterized by a high inflationary environment in Mexico. Nevertheless, Management implemented diverse initiatives aimed at building a more efficient structure, thereby reducing expenses as a percent of sales from 40.2% in 2016 to 38.7% in 2017, which represents an annual reduction of 3.7% on a consolidated level. In Mexico, the company’s operating expenses as of December 31, 2017 were 2.2% below those of 2016. In the United States, we set the objective of stabilizing margins in accordance with the new level of sales, thereby lowering operating expenses by 13.8% in dollar terms.

The progress we have made and our commitment to enhance Grupo Famsa’s financial strength motivate us to continue in 2018 with specific initiatives for executing our asset monetization plan and accessing new funding alternatives to improve the company’s debt maturity profile and the conditions of our currently existing debt.

All of these actions, combined with the maturing and deploying of financial and control best practices which we have been reinforcing across the organization since 2016, will make our financial profile more robust, with appropriate debt levels and a reduced exposure to risks from foreign exchange and interest rate fluctuations, thereby consolidating Grupo Famsa’s competitiveness and assuring its long-term profitability.