Grupo FAMSA's growth is based on its main strengths:

Solid market position in Retail Sector in Mexico.

Advanced information systems and technology created to measure.

Highly expandable and flexible business platform.

Experienced management team with extensive technical capacity.

Extensive experience in retail sales and consumer financing.

Highly trained and motivated human resources.

The commitment and dedication of Grupo FAMSA has been and will continue to be the delivery of products and services of the highest quality, in competitive conditions, through an efficient and profitable execution.

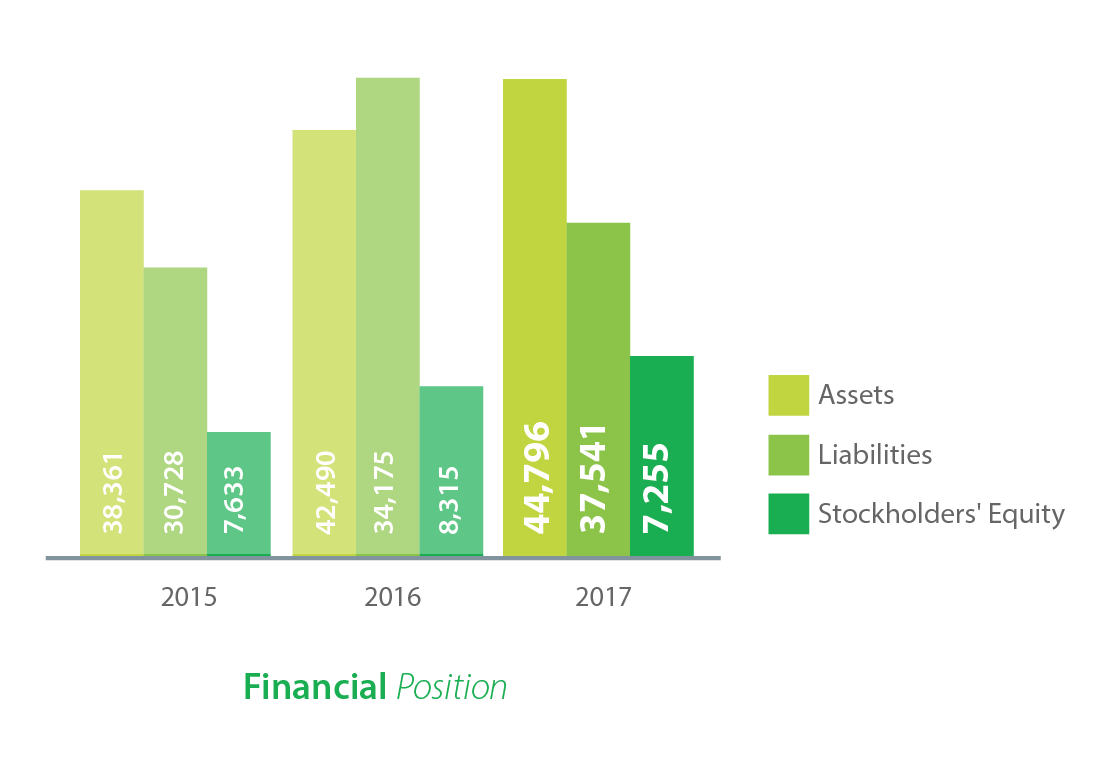

Financial Position

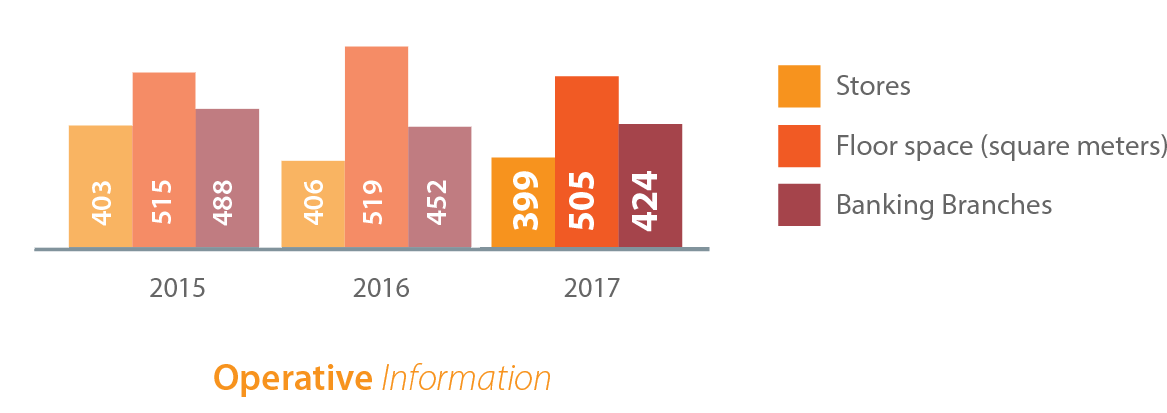

Operative Information

Operative Results

Grupo Famsa, S.A.B. and Subsidiaries

Financial Position

2017

2016

2015

Variation

Assets

$44,796

$42,490

$38,361

10.8%

Liabilities

$37,541

$34,175

$30,728

11.2%

Stockholders' Equity

$7,255

$8,315

$7,633

8.9%

Grupo Famsa, S.A.B. and Subsidiaries

Operative Information

2017

2016

2015

Variation

Total Stores

399

406

403

-1.7%

Mexico

377

380

377

-0.8%

United States

22

26

26

-15.4%

PL USA Branches

26

28

28

-7.1%

Banco Famsa

424

452

488

-6.2%

Banking Branches

391

399

400

-2.0%

Assets

33

53

88

-37.7%

Active Accounts (Millions)

1.2

1.2

1.2

0.0%

Employees

19,380

17,667

19,117

9.7%

Mexico

18,857

17,039

18,396

10.7%

United States

523

628

721

-16.7%

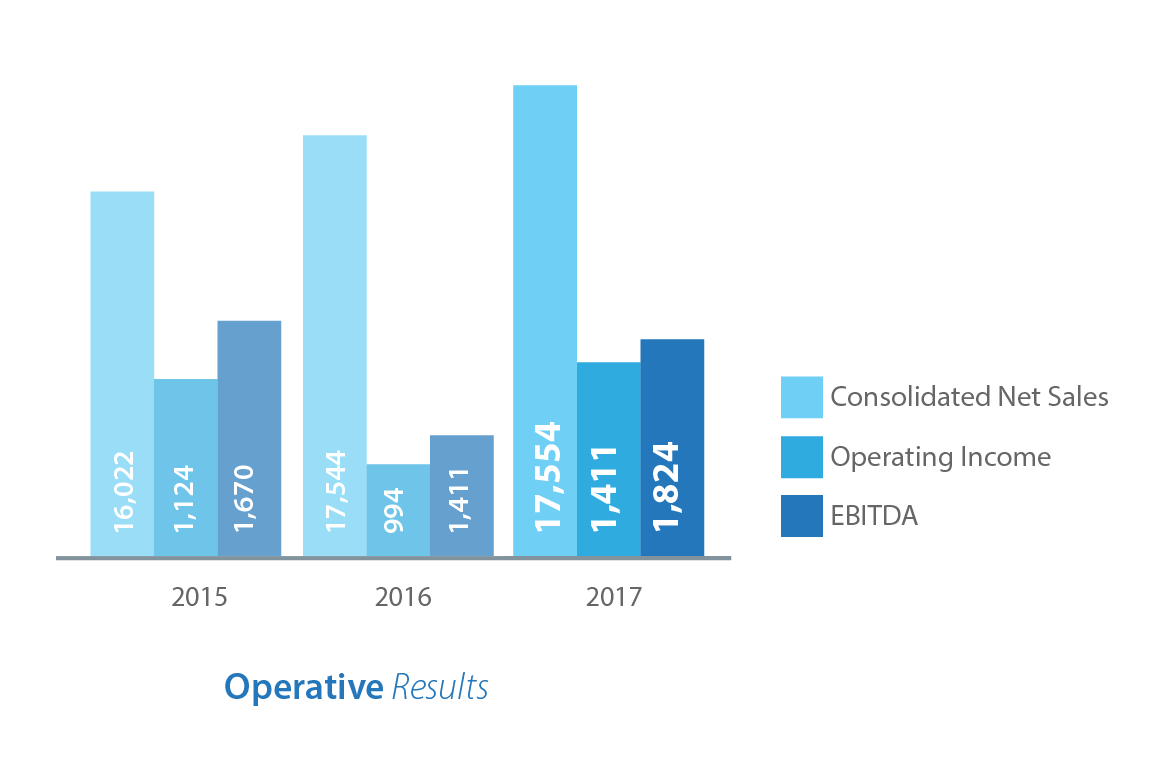

Grupo Famsa, S.A.B. and Subsidiaries

Operative Results

2017

2016

2015

Variation

Net Sales

$17,554

$17,544

$16,022

0.1%

Mexico

$15,605

$15,157

$13,884

3.0%

Unites States

$1,843

$2,265

$2,027

-18.6%

Others

$1,030

$1,020

$941

1.0%

Intersegments

-$912

-$898

-$830

1.6%

Gross Profit

$7,904

$7,819

$7,055

1.1%

EBITDA

$1,824

$1,411

$1,670

29.3%

Operating Income

$1,411

$994

$1,124

41.9%

Net Income

$307

$346

$149

-11.3%

Gross Margin

45.0%

44.6%

44.0%

EBITDA Margin

10.4%

8.0%

10.4%

Net Margin

1.7%

2.0%

0.9%